Ariadne Powers ETH – UZH Top Global Quant Finance Program with Industry-Leading Analytics

- Jonas Brammertz

- Jan 12

- 2 min read

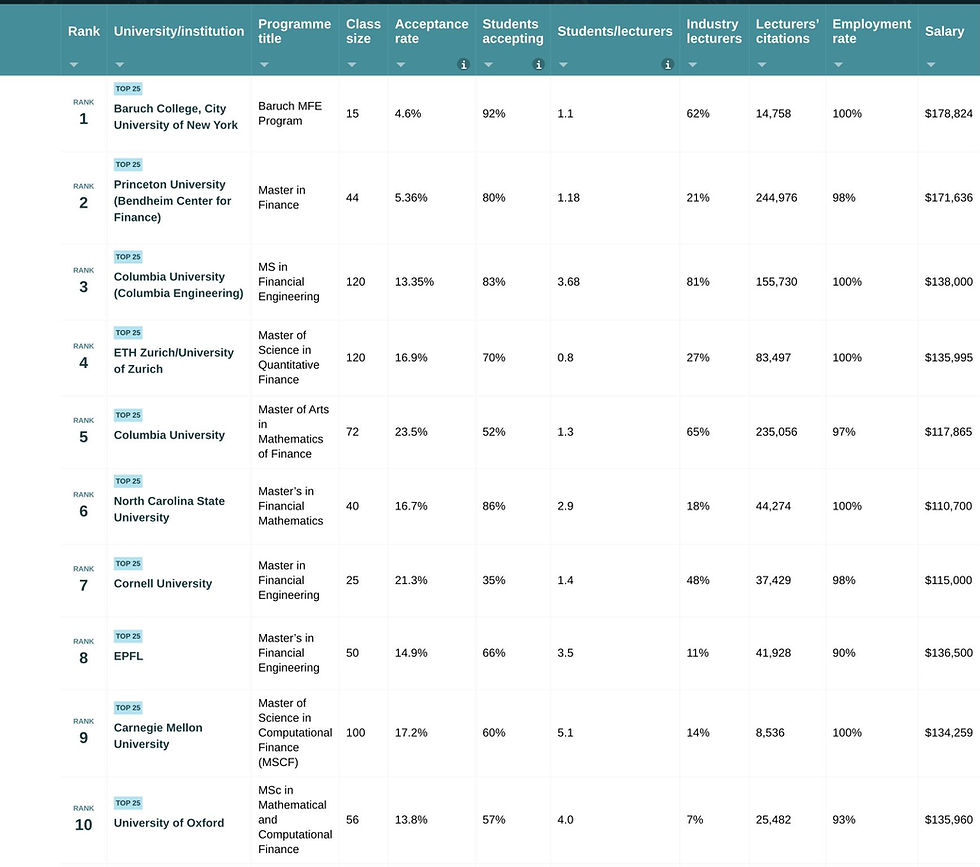

Ariadne Business Analytics AG (Ariadne) is pleased to participate in the Quant Finance program at ETH and the University of Zurich, which once again ranked number 4 in the Risk.net ranking published in December 2025. The ETH–UZH MSc in Quantitative Finance was established to close an important gap between finance and advanced mathematics, and over more than two decades has developed into a globally recognized benchmark. This program consistently ranks among the top 10 worldwide and top 2 in Europe, according to the well-regarded Risk.net quantitative finance rankings.

Since 2009, Willi Brammertz, the founder of Ariadne, has served as a lecturer in the Quant Finance Program, leading the "Risk & Finance Lab." In this role, he guides students in bridging theoretical concepts with practical applications in finance. For the past ten years, Ariadne has provided its state-of-the-art simulation engine AnalytX (based on the Open-Source ACTUS Financial Standard www.actusfrf.org ) for use by students.

Ariadne AnalytX offers a unified analytics architecture for finance and risk that spans from basic accounting to advanced financial risk modeling. It delivers unmatched clarity, simplicity, consistency, depth, and efficiency. It provides treasury, finance, risk and the board of banks and financial institutions with next generation financial analysis and risk management tools. AnalytX enables enabling liquidity planning, budgeting, ILAAP, ICAAP, IRRBB, LCR, etc.

A concrete example of how the “Risk&Finance Lab” bridges the gap between theory and practice is the analysis of the Silicon Valley Bank failure.

In the middle of the spring semester of 2023, two groups of students examined and reconstructed the Silicon Valley Bank’s collapse with the help of Ariadne AnalytX. In only two months, during which they also had to be trained in the use of AnalytX, they were able to complete the task. Even though the “Risk&Finance Lab” was only one of many courses, the students had to follow.

Notably, the student teams managed to analyze what happened at SVB and produce results at around the same time as the FED’s postmortem Barr Report was published. While they relied solely on public sources and complicated, highly summarized call reports - unlike the FED, which was the regulator in the first place and had access to confidential internal data - the figures calculated by the students were only about 20% different from those found by the FED.

See what the students achieved in this video:

Further links:

ETH – UZH Master Quantitative Finance: https://ethz.ch/en/studies/master/degree-programmes/natural-sciences-and-mathematics/quantitative-finance.html

Risk.net. (2025, December 18). 2026 Quant Master’s Guide—ETH-UZH tops European rivals. Risk.net. https://www.risk.net/quantitative-finance/7962867/baruch-princeton-cement-duopoly-in-2026-quant-master%E2%80%99s-guide

Barr, M. (2023, April 28). Review of the federal reserve’s supervision and regulation of silicon valley bank. Federal Reserve. https://www.federalreserve.gov/newsevents/pressreleases/bcreg20230428a.htm

Brammertz, W. (2023, June). SVB Failure Reconstruction—What a Regulator could have seen with ACTUS: [Youtube]. ACTUS Research Foundation. https://www.youtube.com/watch?feature=shared&v=1OxFWdxF0LE

Ariadne AnalytX: https://www.ariadne.swiss/analytx

Comments